MTC and SST Tax Exemption Explained

MTC and SST Tax Exemption Forms

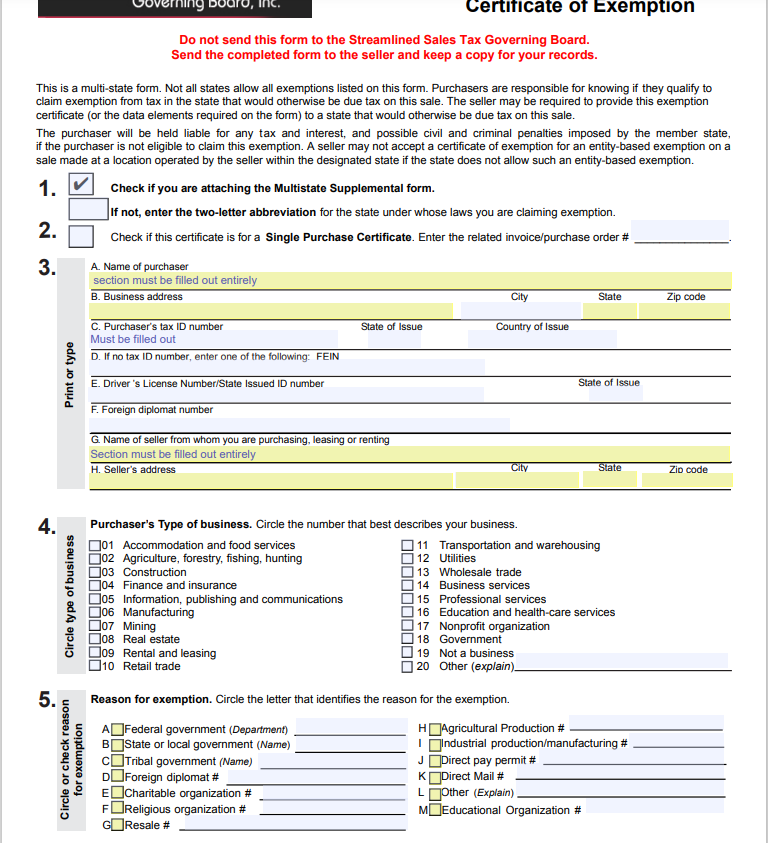

GoVets is always happy to honor your tax exemption status! ALL tax-exempt buyers on GoVets MUST submit Tax Exempt documentation, particularly for the states in which they are claiming Tax Exemption. One of the most common questions we receive regarding tax exemption is the MTC (Multistate Tax Commissions) and SST (Streamlined Sales Tax) form. Although these forms are supposed to simplify things, they can be overwhelming at times. This article we will serve as a guide on how to fill out the MTC and SST exemption forms. If you do not have nexus (not registered with that state) and are unable to provide a certificate for that state, these forms are great alternatives that a majority of states will accept. Please note, there are some states that still require a certificate from that state, although they are part of the Streamline Sales Tax and Multistate Tax Commission.

Below is a guide to how to fill out these forms and submit it to GoVets. Please note, tax laws are continuously changing. If you have any questions, you can always reach out to our customer care department.

Our information MUST be included on each form submitted:

GoVets

2194 Florida A1A Suite 206

Indian Harbour Beach, FL 32937

All tax exemption requests must be submitted on one of the following GoVets pages:

or

Guidance for: Steamlined Sales Tax

24 states on form

All sections must be completed in their entirety

MUST include a live signature

Guidance for: Uniform Sales & Use Tax Resale Certificate (MTC)

37 states on form

All sections must be completed in their entirety

Must be most up date to form- revised June 21, 2022

MUST include a live signature

Footnotes include any details for requirements for each state

Frequently Asked Questions:

Do I need to fill out both forms or only an individual form for a given state?

The MTC form has 37 membering states and the SST form has 24 Streamlined member states. If the states you are requesting tax exemption from are on one form, both forms are not required.

How do I know when to use the MTC instead of the SST?

About half the states that are on the MTC form are also on the SST form. The MTC form has more restrictions than the SST. For example, Florida is not on the SST and requires a Florida exemption certificate. If submitting the MTC form, the footnotes are very detailed on any requirements or restrictions when submitting this exemption form.

What states accept these forms?

The MTC Certificate is accepted by the states listed below as of 2022. However, since state requirements are subject to change, the MTC “cannot guarantee” that all of the states still accept this certificate. Currently, we require the individual certificates for California, Florida, Kentucky, New Mexico, and South Dakota. These states require us to retain their individual certificates although they are on the MTC form.

Alabama,Arizona, Arkansas, California, Colorado, Connecticut, Florida, Georgia, Hawaii, Idaho, Illinois, Iowa, Kansas, Kentucky, Maine, Maryland, Michigan, Minnesota, Missouri, Nebraska,

Nevada, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Washington, and Wisconsin.

Like the MTC, the SST provides a multistate exemption certificate, This certificate is accepted by the 24 SST member states listed below. You do not have to be registered in these states to use this form. Acceptable ID numbers are state ID, passport number, driver's license number, or your FEIN number. If you have nexus in the state you are listing on the form, you would use your state ID number on the form.

Arkansas, Georgia, Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, North Carolina, North Dakota, Nebraska, New Jersey, Nevada, Ohio, Oklahoma, Rhode Island, South Dakota, Tennessee, Utah, Vermont, Washington, West Virginia, Wisconsin, and Wyoming.

Do I need to also submit these forms to the States that I'm claiming Tax Exemption for?

These forms do not need to be submitted to the states that you are claiming tax exemption. A fully executed certificate must be submitted to the supplier that you are seeking tax exemption from.

Do I need to wait for a State Registration Number to fill out this form?

Some states allow the use of another state's registration number in leiu of their state's registration number on the MTC form. Some states require their state registration number. For example in Pennsylvania, the certificate must contain the purchaser’s sales and use tax license number.

If you have any further questions, please feel free to contact us through our instant live chat function on the bottom right of GoVets' home page or submitting a ticket request. We would be more than happy to help!