GoVets Knowledge Base

Search our FAQs or browse by category belowDoes GoVets contribute to nonprofit causes as well as not-for-profit companies?

As a socially responsible organization, we want to support as many causes as possible that support our Veterans. We believe that there may be small groups that can benefit from GoVets Giving as much, if not much more than larger nonprofit organization. Smaller not-for-profit organizations that may be organized to address local events, groups, may not be 501(c)(3), but may be doing amazing work for their local veteran community. We want those organizations to benefit as much from GoVets Giving as anyone else.

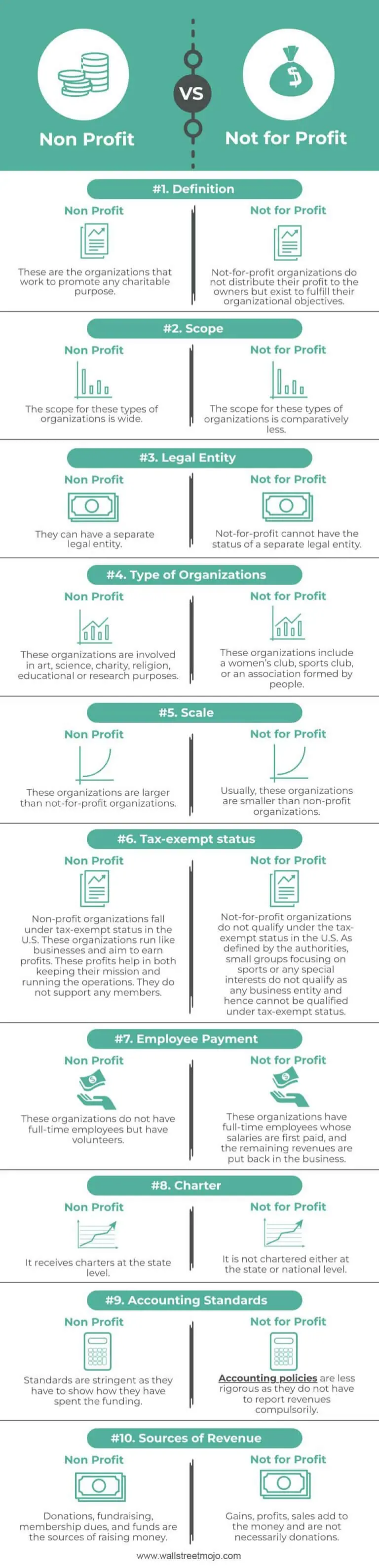

The amazing chart below from WallStreeMojo explains the differences between Non Profit and Not-for-Profit organizations, which is summarized in this table:

Non-Profit |

Not-for-Profit |

What is a Non-Profit?Organizations that work to promote any charitable purpose. |

What is a Not-for-Profit?Do not distribute profit to the owners but exist to fulfill their organizational objectives. |

What is the Scope of a Non-Profit?The score for non-profits is very broad and wide and can cover several support areas, regional and/or states. |

What is the Score of a Not-for-Profit?The score for a not-for-profit is very focused and specific to a group, local area and/or local interest. |

What is the legal entity for a Non-Profit?Non-profits can have separate legal entities, such as 501(c)(3) or similar. Additional details can be found in the Charities and Nonprofits and Charities section of the IRS.gov. |

What is the Legal Entity for a Not-for-Profit?A not-for-profit cannot have the status of a separate legal entity. |

What are examples or types of non-profit (nonprofit) organizations?Non-profit organizations are associated with art, science, charity, religion, educational, research, Veterans causes, etc. |

What are examples of not-for-profit organizations?Not-for-profit organizations are associated with sports clubs, associations formed by groups of people, veteran support groups, women's clubs, etc. |

What is the scale of a non-profit organization?Non-profit organizations are larger than not-for-profits. |

What is the scale of a non-profit organization?Usually, these organizations are smaller than non-profit organizations. |

What is the Tax-exempt status of a Non-profit organization?Non-profit organizations fall under tax-exempt status in the U.S and run like businesses that aim to earn profits. These profits help in both keeping their mission and running the operations. |

What is the Tax-exempt status of a Not-for-Profit organization?Not-for-profit organizations do not quality under the tax-exempt status in the U.S. As defined by the authorities, small groups focusing on sports or any special interests do not qualify as any business entity and hence cannot be qualified under tax-exempt status. |

How do Non-profits pay their employees?Non-profits typically have volunteers and do not typically have paid employees. |

How do Not-for-Profits pay their employees?Not-for-profits have employees with salaries, but remaining funds are added back to the business bank accounts. |

How does a Non-profit receive its charter?Non-profits receive their charter at the state level. |

How does a Not-for-Profit receive its charter?Not-for-profits are not chartered at the state or national level. |

Are their any accounting standards for non-profits?Non-profits must show how funds have been spent towards their cause. |

Are their any accounting standards for not-for-profits?Not-for-profits have less rigorous accounting standards and have less revenue reporting requirements. |

How do non-profits receive their sources of Revenue?Non-profits receive revenue and income from donations, fundraising, membership dues and funds. |

How to Not-for-Profits receive their sources of income or revenue?Not-for-profits receive gains, profits, sales add to their money within the organization and are not necessarily donations contributed to the organization. |